Financial

Financial Programming

Are you interested in becoming financially literate? We offer financial resources for you to use that will help you gain or increase your skills and abilities to understand or better understand how to make effective financial decisions.

Visit the Financial Education Division of Extension website for further financial education.

Financial Coaching

–

Money Matters

Money Matters is a program designed to improve your financial habits. Through this course, you will gain money management skills and build knowledge you can share with your family and friends. The course is offered both online and through county Extension offices.

Money Matters Live is now open for Fall 2024 sessions! Come learn about financial basics every Wednesday in October.

Financial Coaching is a program designed to improve your financial habits. Through this online course, you will gain money management skills and build knowledge you can share with your partner, family and friends.

You may choose from online, Self-Study only, or Online Self-Study with Financial Coaching.

“529” Wisconsin’s Savings Plan

—

Edvest

Parents, grandparents, and community members can all help a child realize their potential, by putting money aside for future education. When the child is ready to continue their education, the funds can be used for tuition, room & board, books and more. And, the best part is that there are no income tax on those withdrawals. Plus, the depositor gets a Wisconsin state tax credit on their contributions. Learn more about Wisconsin’s 529 plans, Edvest in Tomorrow’s Scholar at edvest.com.

Money Smart Wisconsin

Stay tuned for more information.

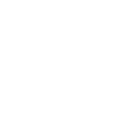

Credit Report

Information on how to build and maintain your credit and manage your credit score.

By law, everybody can obtain free credit reports each year at AnnualCreditReport.com. It is important to check your report regularly to make sure it is accurate and up to date. The credit reporting system is set up so that you are responsible for finding and correcting errors in your reports.

We encourage you to mark your calendars on 2/2, 6/6, and 10/10 this and every year as a reminder to request a copy of your free report on those days. You can order your free reports anytime during the year. The “2/2, 6/6, 10/10” reminder dates are meant as a simple way to remember to pull your free credit reports regularly.

Planning AHEAD

Planning AHEAD is an end-of-life planning curriculum for all ages developed by UW–Madison Division of Extension faculty and staff. The 7-session research-based program will help participants understand how to prepare for the end of life for themselves or a loved one, and why it’s important to have a plan in place. For details on upcoming classes, click here!

For participants, click here for the course materials.

Encouraging Financial Conversations

Unsure about how to discuss money with your clients? Encouraging Financial Conversations is an Extension developed series that will help you engage in positive conversations around money. The six-hour training is geared for helping professionals (case managers, social workers, and other front line staff), but open to anyone! You will learn how to help empower others to achieve their financial goals and manage their money.

Tax Help

UW-Extension provides up-to-date educational information regarding taxes. Take a look here.

Rent Smart

Rent Smart focuses on the knowledge and skills essential for a successful renting experience. It challenges participants to know and understand their rights and responsibilities as a tenant, as well as know and understand the rights and responsibilities of their landlord. Emphasis is on forming a strong partnership between the tenant and landlord. Establishing a positive rental history is much like having a positive credit report and Rent Smart starts participants on the right path for success.

For more information or to sign up for upcoming classes, click here.